Balderson Calls for Tax Fix in Coronavirus Relief Package to Allow Restaurants and Other Small Businesses to Reinvest in Facilities

WASHINGTON, D.C.,

March 23, 2020

WASHINGTON, D.C.—Congressman Troy Balderson (R-OH) is urging congressional leaders to include an overdue tax fix in phase 3 of the coronavirus relief package, incentivizing small businesses, including restaurants, to reinvest in their facilities and hire local contractors.

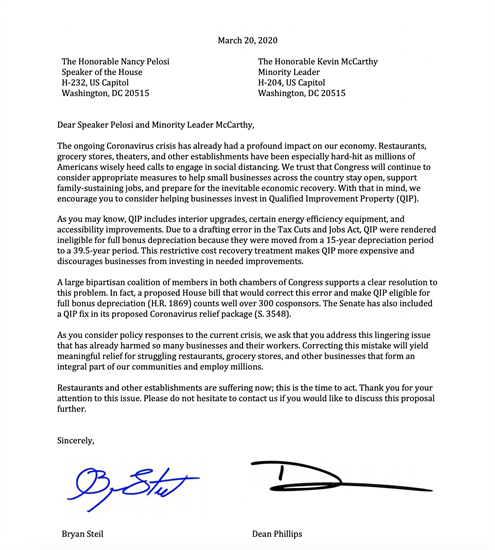

"As we rightfully practice social distancing to protect our communities and loved ones, Ohio’s small businesses are hurting," said Balderson. "As Congress works to deliver meaningful relief, this legislation will add yet another tool in small businesses’ toolbox to reinvest, rehire, and recover from this crisis." Despite overwhelming bipartisan congressional support to remedy a recent change to depreciation rules for improvements made to real property, known as Qualified Improvement Property (QIP), congressional leaders have failed to advance legislation that fixes the error. Balderson and a bipartisan group of more than 300 members of Congress are calling on Speaker Pelosi to move this proposal forward. "The Ohio Restaurant Association is asking elected officials in Congress to retroactively fix the error in the tax overhaul qualified improvement property (QIP) bill," said John Barker, president and CEO of the Ohio Restaurant Association. "This would change depreciation for restaurant capital expenditures from 39 years back to 15, and enable business owners to begin investing capital again. This will reignite major renovation projects that create architect and construction industry jobs and result in revenue growth that drives restaurant industry job expansion." “When Ohio’s companies reinvest in facility upgrades, they’re also investing in the thousands of skilled, professional contractors and subcontractors, service providers, suppliers and their employees that perform the work. We applaud this job-sustaining effort, which will have a positive ripple effect for Ohio’s economy during this challenging time,” said Rich Hobbs, Associated General Contractors of Ohio executive vice president. Click here to view full letter. |

Press Releases

Stay connected

Enter your information to get the latest updates via our newsletter

The latest

-

This article was originally published by the Cleveland Plain Dealer. By Sabrina Eaton WASHINGTON – The U.S. House of Representatives on Wednesday passed legislation by Zanesville R...

-

WASHINGTON, D.C. – Today, the House of Representatives passed the Reliable Power Act, introduced by Congressman Troy Balderson (OH-12). This legislation protects America’s electric...

-

WASHINGTON, D.C. – Congressman Troy Balderson (OH-12) joined President Donald Trump and Transportation Secretary Sean Duffy in the Oval Office today for the announcement of the “Fr...

-

WASHINGTON, D.C. – Congressman Troy Balderson (OH-12) today introduced legislation to streamline America’s energy projects by ensuring a project can move forward without being trap...